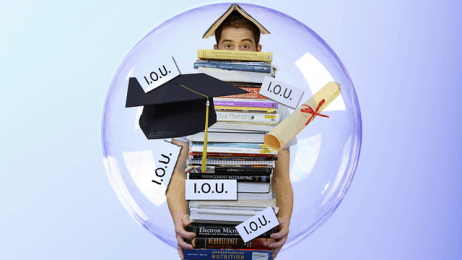

Should I Use a Credit Agency as a Bankruptcy Alternative?

Daniela2023-07-22T10:48:25+00:00If you are struggling with debt, you are probably weighing your options to see what will work best for you. This is exactly what you should be doing. However, you should know that credit counseling businesses can only help so much. For example, they are unable to negotiate with the IRS. They also cannot help [...]